By embedding memory as a core architectural component, Layerup's Agentic OS enables financial institutions to deploy progressively smarter AI agents that remember, learn, and scale across collections, claims, and servicing workflows.

Banks and insurers run mission-critical workflows that demand precision, auditability, and speed at massive scale. Generic AI tools improve productivity at the edges, but industry-specific AI agents can run the institution by combining domain grounding, workflow execution, integration, and compliance.

Layerup's Agentic OS now supports OpenAI's GPT-5, delivering advances in decision intelligence, adaptive verbosity, deep reasoning, and secure API orchestration for enterprise-grade AI agents.

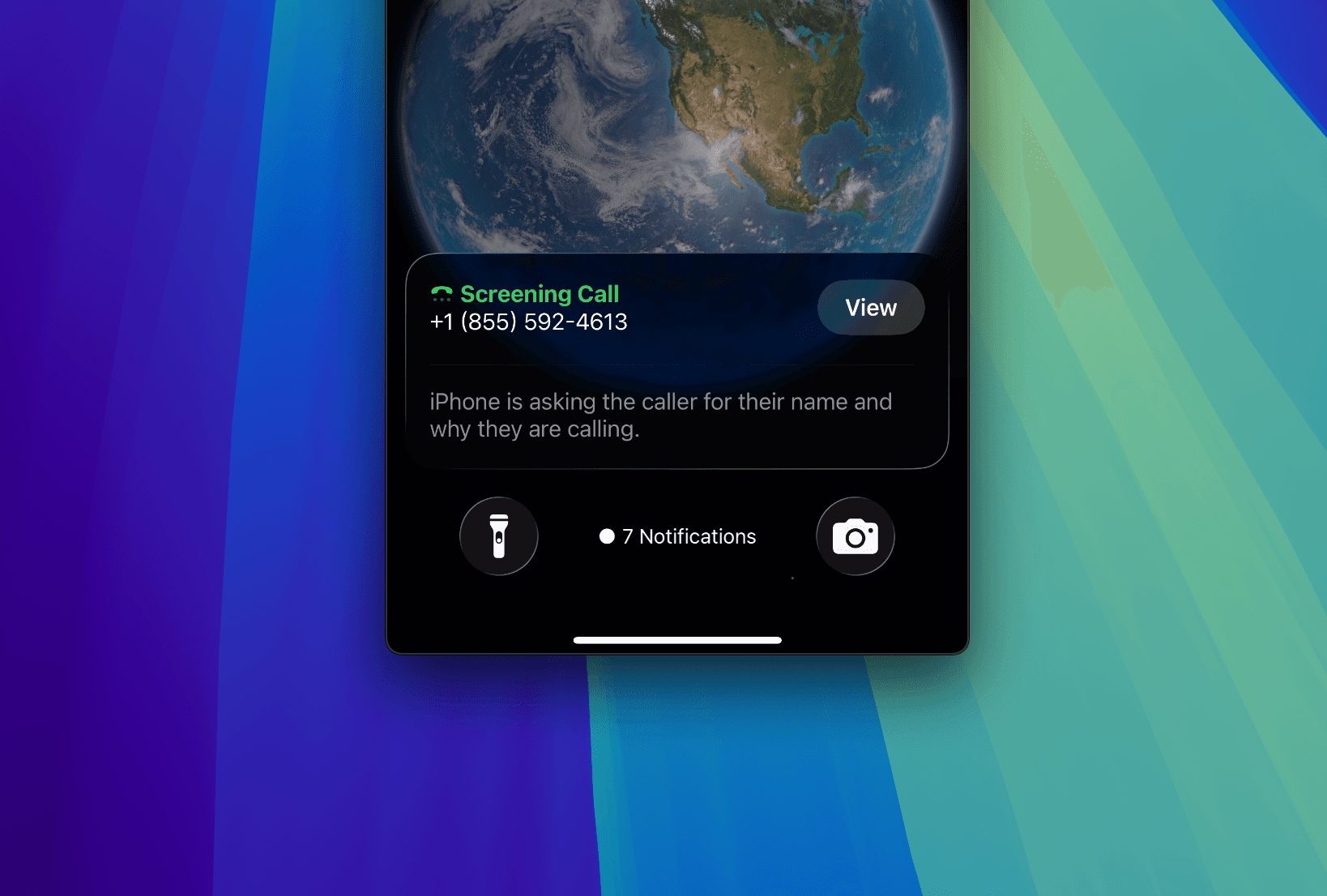

Apple's iOS 26 call screening update creates new challenges for financial institutions. Learn how Layerup's Voice AI Agents turn this barrier into a competitive advantage through intelligent call handling and compliance-ready interactions.

Key takeaways from the NAF Non-Prime Auto Financing Conference on how Voice AI agents are transforming auto finance. Modern voice AI goes beyond answering questions—they execute real actions in collections, self-service, and loan origination, all while embedding compliance and driving value across the lending lifecycle.

Examining why AI agents in auto finance must go beyond servicing to deliver value across the customer lifecycle, from origination to collections and compliance.

Exploring the need for specialized conversational AI solutions in financial services to address regulatory compliance, operational efficiency, and data security.

Exploring the role of voice AI in enhancing customer support, collections management, and regulatory compliance in the auto finance industry.

Enhancing Customer Support, Collections, and Compliance with AI-Powered Conversations

Reducing Costs, Improving Collections, and Enhancing Compliance with AI-Powered Conversations

Explore the advantages of AI over traditional agencies in debt collection, highlighting enhanced borrower engagement, operational efficiency, and cost-effectiveness.

Explore how generative AI tailors outreach strategies, enabling banks and lending institutions to connect with borrowers more effectively, increase engagement, and improve recovery outcomes.

Learn how leveraging AI agents across phone calls, text messaging, and emails delivers a cohesive debt recovery experience, leading to higher response rates and improved borrower satisfaction.

Discover how voice-enabled AI agents provide natural, empathetic conversations that foster trust, encourage repayment, and streamline the debt recovery process.

Examine how AI-powered text messaging campaigns utilize personalization, timing, and data-driven insights to engage borrowers, improving response rates and repayment success.

Learn how generative AI transforms email outreach into a dynamic, borrower-centric tool, enhancing engagement through personalized messaging and smarter follow-ups.

Explore how AI-driven workflows reduce administrative burdens, streamline approvals, and increase operational efficiency within debt collection efforts.

Understand how source citation capabilities built into AI agents provide clarity and confidence, helping financial institutions make better-informed decisions.

Learn how AI agents use chain-of-thought reasoning to understand complex borrower scenarios, refine strategies, and improve the overall debt recovery approach.

Explore how detailed analytics from AI agents support financial leaders, offering data-driven insights to optimize outreach, allocate resources, and boost recovery performance.

Discover how embracing generative AI technology positions banks, credit unions, and other lending institutions at the forefront of innovation, driving higher recovery rates and greater borrower engagement.